This is a post in a series about Taking Marketing’s Vitals—a crash course in figuring out how to fix marketing at your startup.

Each post breaks down 1 of the 11 components of a healthy marketing system, helping you understand each component, why it's essential to your overall system, and how to take its vitals. To get updates on future posts in this series, hit the button below:

For this post, I interviewed Sara Gordon, a startup positioning expert who has helped global brands like Flo Health, GlaxoSmithKline, and Incident.io nail their positioning to unlock growth.

What even is positioning?

Put simply, positioning provides the most important context to customers that helps them make decisions—not only about which products to buy but also about pretty much everything in life.

If your positioning is off, there is a 100% chance the rest of your marketing system will break. Yet, positioning is one of those marketing concepts many people talk about but not many understand.

Ultimately, it’s an exercise in framing. All of us are deciding between options and framing influences the way we compare those options.

Take my dad, who is considering retirement. I recently talked to him after he had a draining back-and-forth with a demanding customer, and he said to me: “Libby, I don’t get it. In other jobs, I’ve had dozens of interactions like this every month, and it hasn’t made me want to walk away. But I just don’t want to deal with customers anymore.”

The marketer in me couldn’t help it. I had to point out that his frame of reference had changed: He used to compare his job to other jobs, and now he was comparing his job to retirement. If doing whatever he wants whenever he wants is the alternative, even one challenging customer interaction in a month was enough to make him want to walk away.

Positioning = The Heart of a Healthy Marketing System

Think about how many marketing messages you’re bombarded with in a given day and how quickly you judge whether or not a product or service is worth your time and attention.

You have 3-5 seconds to grab someone’s attention—and 60 seconds to convince them to explore further.

That’s it.

Positioning is so important because we rely on all sorts of psychological shortcuts to make decisions quickly. When you position your product properly, you trigger a set of assumptions about your product or service that frame it in a way that is intuitive to your customer’s brain.

Although it can feel “fluffy”, positioning flows through all your marketing—what you say in your ads, on your website, in sales collateral, how you set up new customer onboarding, and what you emphasize in lifecycle marketing. So if it isn’t working, you’re toast.

How Does Positioning Work?

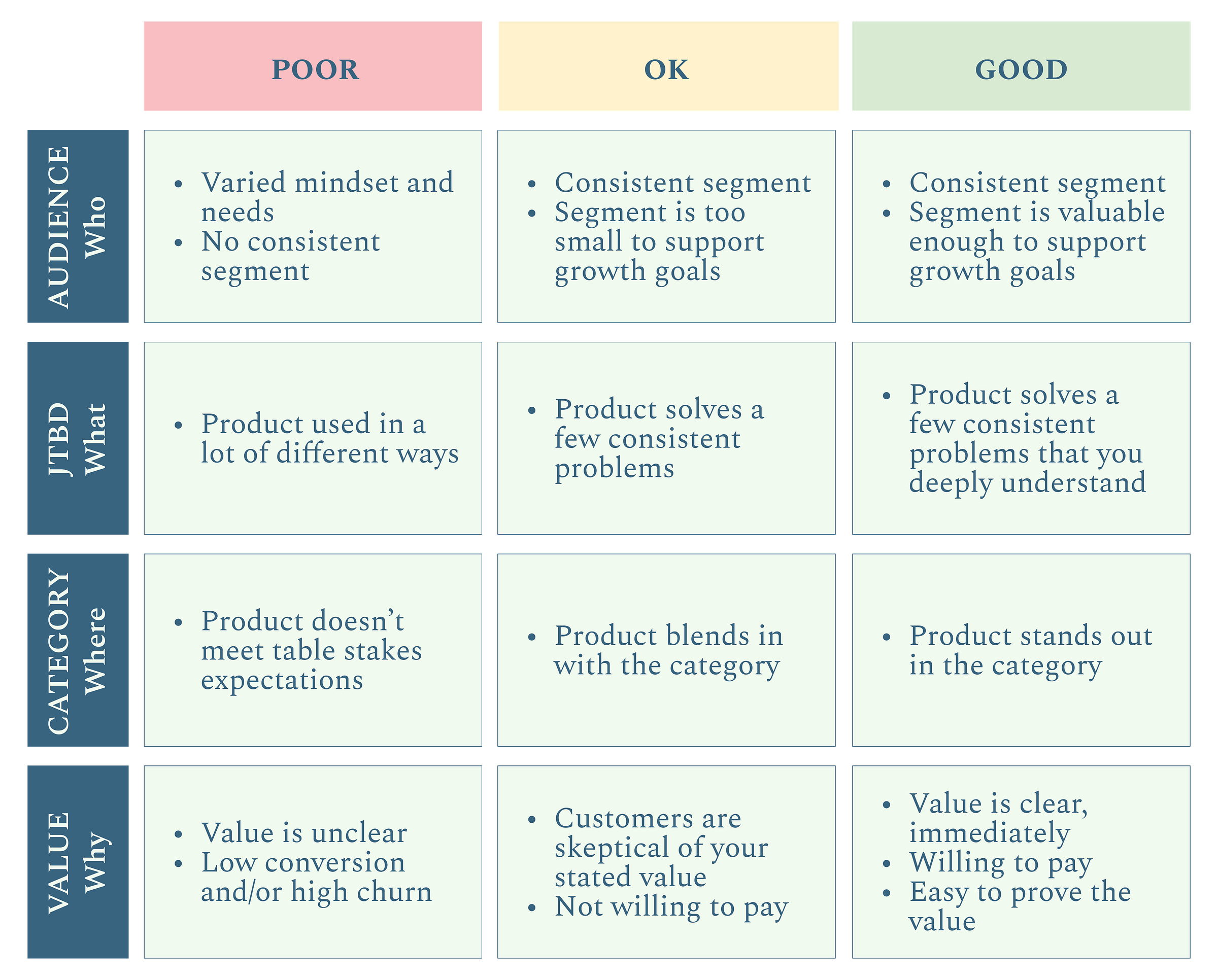

Nailing positioning requires clarity on 4 things:

WHO | Target audience: Who cares a lot about the value your product offers? How valuable is that segment?

WHAT | Job-to-be-done (JTBD): What problem is your product solving? What job are customers hiring you to do?

WHERE | Category: Where does this product live in your customer’s brain? What expectations do customers have of this category?

WHY | Differentiated Value: Why your product? What benefits do you offer, and how does that relate to your customer’s goals? How are you different from (and better than) alternative solutions within the category?

That’s a lot of jargon … to simplify it, Sara walked me through a story about Bloom & Wild, Europe’s #1 online flower company. Initially, the product was set up as a recurring flower subscription, most likely for self-purchase.

The addressable market for self-purchase was quite small, as the number of women who treat themselves to flowers each week is a luxury corner of the market. Sara and the team started to explore how to crack a larger addressable market.

She started by looking for anomalies in the data: “One of the things we realized was that people were canceling the subscription after the first or second order. And the delivery address didn’t match billing.”

After talking to some of these customers, she learned they were hiring Bloom & Wild to send a thoughtful gift to loved ones.

WHO | Target audience: The target audience shifted from high-income women who cared a lot about keeping a well-decorated home each week to a much broader target of women sending gifts to loved ones multiple times a year.

WHAT | Job-to-be-done (JTBD): The use case for the product was sending a gift, but the specific JTBD uncovered in user research was that these customers wanted to connect with a loved one in a thoughtful way. They cared much more about the emotional connection the gift created rather than just the gift itself.

WHERE | Category: The gifting category was much bigger and different than the flower category. Digging into more user interviews and research, Sara learned that customers expected players in this category to allow for customization and personalization of the gift, to add that thoughtful touch, but also wanted to be able to easily find the right item and ship it fast.

WHY | Differentiated Value: Bloom & Wild had a few benefits it could use to its advantage. Unlike a player like Etsy who had a massive catalog and shipping times of 3+ weeks for personalized gifts, they could ship flowers quickly. The company’s innovation of shipping flowers in a flat-packed letterbox not only improved shipping time and quality. The team found that since the recipient had to assemble the bouquet, it actually built a stronger affinity and emotional connection with the gift as compared to a small trinket that gets unboxed and placed aside.

Is Your Positioning on Life Support?

When your positioning is working:

Customers convert quickly because it’s immediately obvious to them how your product fits into their life and why they should try it

Customers stick around because the actual experience of the product matches their expectations

If you talk to a bunch of customers, they’ll describe the product and its value similarly

When your positioning isn’t working:

Some customers get it, but some don’t

Many are skeptical that you actually can help them with their problems

If you showed your website to 10 strangers on the street, you’d get a lot of different answers back on what your product is all about

If you think you might fall into the latter camp, take some time to examine the four components of your positioning.

You can use existing qualitative and quantitative data, or Sara recommends doing 8 to 10 interviews with customers who've just signed up and are in the moment of trying to solve the problem and then 8 to 10 existing customers who love the product.

Let’s break this down with another example from Sara—Incident.io, a software platform that helps cross-functional teams manage incidents.

Target audience | POOR: The product was used by several different segments. One segment was junior engineers who often discovered the tool while on call during an incident and were looking for ways to avoid having to be online at midnight in the future. Another was engineering leaders who were looking for opportunities to scale their operations while retaining teams.

Jobs-to-be-done (JTBD) | OK: The job varied a bit across these different segments. The junior employee was focused on a narrower problem of minimizing the number of times they’d have to work outside of business hours on an emergency incident. The engineering leaders, on the other hand, were really focused on retaining software engineers and allowing the business to flourish.

Category | OK: The product was originally built as a Slack integration, so for the junior engineer, it was in the category of “free tools to get my job done.” Since the frequency of incidents is typically irregular, that category didn’t necessarily highlight the product's true value. Junior engineers placed more value on tools that they used all the time in their daily workflows. Meanwhile, engineering leaders weren’t paying any attention to this category for solutions to their primary job.

Differentiated Value | OK: As a simple “Slack integration” the perceived value was not high enough. Even though it was helping engineering leaders to provide a better employee experience, they weren’t seeing that value and therefore unwilling to pay a premium.

After uncovering these different segments and jobs-to-be-done, Sara helped incident.io reposition as a risk management platform, unlocking a better sell into engineering managers by delivering more commercial value.

Digging deeper into the mindset of this refined target audience, the team identified an ideal customer profile as one with a strong culture that places a lot of value on employee experience. They pulled this new focus through the product roadmap and the marketing and creative to focus on their most important users.

3 Mistakes to Avoid

In Sara’s work, she sees startups fall into a few common traps:

#1 - Overpromise, Underdeliver: It’s tempting to exaggerate the value you offer in your marketing. After all, this often leads to stronger engagement, more prospects, and sometimes even more new customers. But the problem is, these customers will churn, and not only will you lose the business, but also you’ll harm your brand’s reputation. One particular area for startups to be careful with is influencers. From Sara:

“UGC is such a common acquisition tool now that brands can get away with influencers saying a lot more, particularly for consumer products. I tend to see brands promising the moon and then customers get to the landing page and you look at the ingredients or you look at the reviews and it's not exactly all it's cracked up to be. Don’t forget you will likely need to retain them beyond their first order.”

#2 - Product Features Over Human Needs: Another problem is that startups often focus so much on innovation and technology itself that it falls flat when they try to articulate the value to customers. Customers don’t necessarily consider the underlying technology when making a purchase. They care about what the technology unlocks for them and connect with language and stories that are told through the lens of their problems, wants, and desires rather than through the lens of the product. From Sara:

“This is happening all the time now with AI powered technologies. Everyone wants to talk about their AI! For example, Flo is a period tracking app that uses AI to power many parts of the experience like their algorithm and chatbots. But what women want is private, confidential, quick health advice from a certified doctor, not an AI chatbot. Shifting the focus from the tooling itself to whatthe chatbot could unlock for women, showed much more positive results for Flo and health outcomes for their users”

#3 - Confusing Loyal Customers With Prospects: Startups get a lot of positive feedback from their biggest fans, and it’s easy to mistake that for a signal on positioning. But to figure out your positioning, you need to ask people currently struggling with a problem that your product can solve. From there, try to get to the heart of the job that they're hiring you for. Find out what was happening in their life at the time in great detail. Instead of asking leading questions about the ins and outs of your product, ask open-ended questions about their goals and experience, such as:

When you bought our product, do you remember what you hoped it would enable you to do? Why was doing that so important to you?

Do you remember when you first realized you needed to do [their stated goal]?

What other options did you consider or try to accomplish this goal? Why these?

How did you first discover our product?

What motivated you to try it? What made you worry? Why?

In Summary

Before assuming your content roadmap is wrong, or your channels aren’t set up properly, evaluate your positioning.

It is the heart of a healthy marketing system. All it takes is talking to a handful of prospects to give yourself a positioning health check:

WHO | Target audience: Do your customers fit into a consistent segment that is large enough to meet your growth goals for the next 12-18 months?

WHAT | Job-to-be-done (JTBD): Are customers using your product to solve similar problems? Do you understand their mindset when looking for a solution to that problem?

WHERE | Category: Does your product exceed expectations compared to what the customer expects from the category? Do you have a clear list of alternatives?

WHY | Differentiated Value: Do customers immediately understand the value you offer, and are they willing to pay for it? Can you build claims around it?

You can get in touch with Sara Gordon at www.sarakategordon.com.